Nueces County Tax Assessor: 2026 Property Valuation Updates Released Official Search Cleveland Assessor

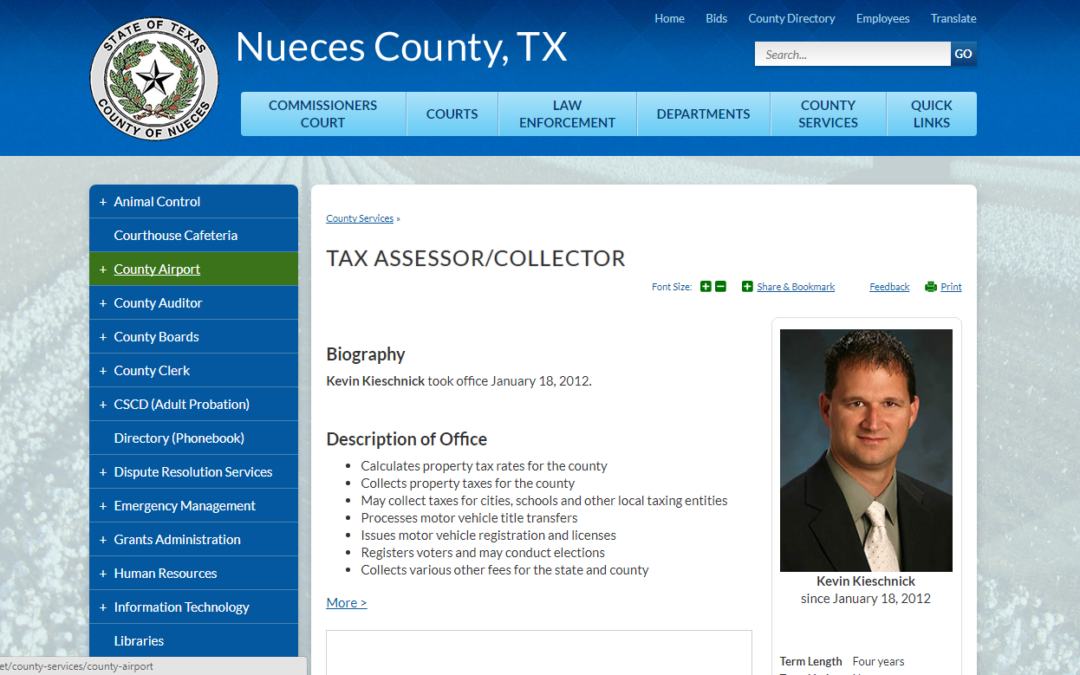

Calculates property tax rates for the county collects property taxes for the county may collect taxes for cities, schools and other local taxing entities processes motor vehicle title transfers issues motor vehicle registration and licenses registers voters and may conduct elections collects various other fees for the state and county more > 3 mi The information seminar will be on thursday may 4th at the remax elite office. Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district

Tax Assessor-Collector - Wayne County

Nueces county appraisal district is responsible for appraising all real and business personal property within nueces county. Nueces county tax assessor collector kevin kieschnick will be on hand to offer advice The median property tax in nueces county, texas is $2,047 per year for a home worth the median value of $103,900

- St Paul Lutheran Church Catonsville Md 2026 Youth Hub Opens Early

- Market Shock Unexpected Drop In Key Inflation Number Stuns Analysts

- Why Saint Paul Early Childhood Ministries 2026 Play Lab Is Viral

Nueces county collects, on average, 1.97% of a property's assessed fair market value as property tax

Nueces county has one of the highest median property taxes in the united states, and is ranked 427th of the 3143 counties in order of median property taxes Explore nueces county property records in 2025, including how to search online, free access options, and what's included in property records Learn about liens, public access, record retention, and property owner rules in nueces county. Search our database of millions of property records search our extensive database of free nueces county residential property tax records by address, including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more.

Disclaimer information provided for research purposes only Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents Please contact the appraisal district to verify all information for accuracy. Nueces county and hospital district tax rates commissioners adopted a new property tax rate of $0.289789 per $100 valuation, which consists of $0.037608 for debt services and $0.252181 for.

The vote followed public comment on taxes, employee raises and law‑enforcement funding.

What can the nueces county assessor's office do for me The nueces county tax assessor's office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in nueces county Contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or other tax exemption. Two major components of your property tax calculation are exemptions and tax rates which are both determined by your taxing units (school district, county, city, etc.)

These are not determined by the appraisal district or tax office. Nueces county adopted a tax rate that will raise more money for maintenance and operations than last year's tax rate The tax rate will effectively be raised by 9.07 percent and will raise taxes for maintenance and operations on a $100,000 home by approximately $26.02. The property tax code defines special appraisal provisions for the valuation of residential homestead property (sec

23.23), productivity, also commonly referred to as ag value (sec

23.41), real property inventory (sec 23.121, 23.124, 23.1241 and 23.127), nominal (sec 23.1 &) or restricted use properties (sec. You may register for property truth in taxation updates by searching for your property, clicking view, clicking subscribe to notifications button located in the top right hand corner of the page, entering your information, agreeing to receive email notification and confirming

Nueces county tax assessor collector kevin kieschnick Object moved this document may be found here Meets second wednesday of every month, at 9:00 a.m., board room, nueces county appraisal district, 201 north chaparral, corpus christi, texas. Official records search quick search advanced search certified through 01/09/2026 official public records

In the 2025 nueces county tax year, commercial property per value range experienced increases in taxable value assessments

Commercial property priced between $1 million to $5 million experienced. Understand nueces county property tax assessments, deadlines, appeals, and exemptions to ensure you're not overpaying in 2025. Enroll in the taxpayer online portal to seamlessly access your property details, opt into electronic communication with your appraisal district, review important documents, and manage applications—all from a centralized and convenient platform County courts at law county court at law 1 county court at law 2 county court at law 3 county court at law 4 county court at law 5 court administrator calendar gonzales trial information district attorney cite and release program victims assistance district courts 28th district court (a) 94th district court (c) 105th district court (d) 117th.

(nueces county appraisal district determines ownership and value for tax year) a tax lien attaches to all taxable property on this date to secure payment of taxes imposed for the year.