The Updated Nueces Appraisal District Property Search Tool Reveals Tax Hikes Login County

Disclaimer information provided for research purposes only Information provided for research purposes only Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents

Nueces County Property Tax Loans Ovation Lending

Please contact the appraisal district to verify all information for accuracy. The provisions of the texas property tax code govern the legal, statutory, and administrative requirements of the appraisal district. Meets second wednesday of every month, at 9:00 a.m., board room, nueces county appraisal district, 201 north chaparral, corpus christi, texas.

- Why Glen Stream Md 2026 Water Purity Results Shocked Local Experts

- Diversified Recruitment Strategies Define The Legacy Of St Pauls Admissions

- Viral Gospel Concert Clips From Baptist Church Glen Burnie Md Tours

Explore nueces county property records in 2025, including how to search online, free access options, and what's included in property records

Learn about liens, public access, record retention, and property owner rules in nueces county. Use taxnetusa's nueces appraisal district data to find comps and property information for gathering evidence to appeal a client's property taxes Access appraisal data, see property value, exemptions, and much more. Nueces county tx appraisal district real estate and property information and value lookup

Phone, website, and cad contact for the cities of agua dulce, alice, banquete, bishop, chapman ranch, corpus christi, driscoll, port aransas, portland, robstown, sandia. Search for property information in nueces county by owner, address, id or using advanced search options. The nueces county appraisal district expressly disclaims any and all liability in connection herewith. Explore nueces county, tx property records 🏡, transaction records, land office details, and appraisal info

Conduct your property records search today!

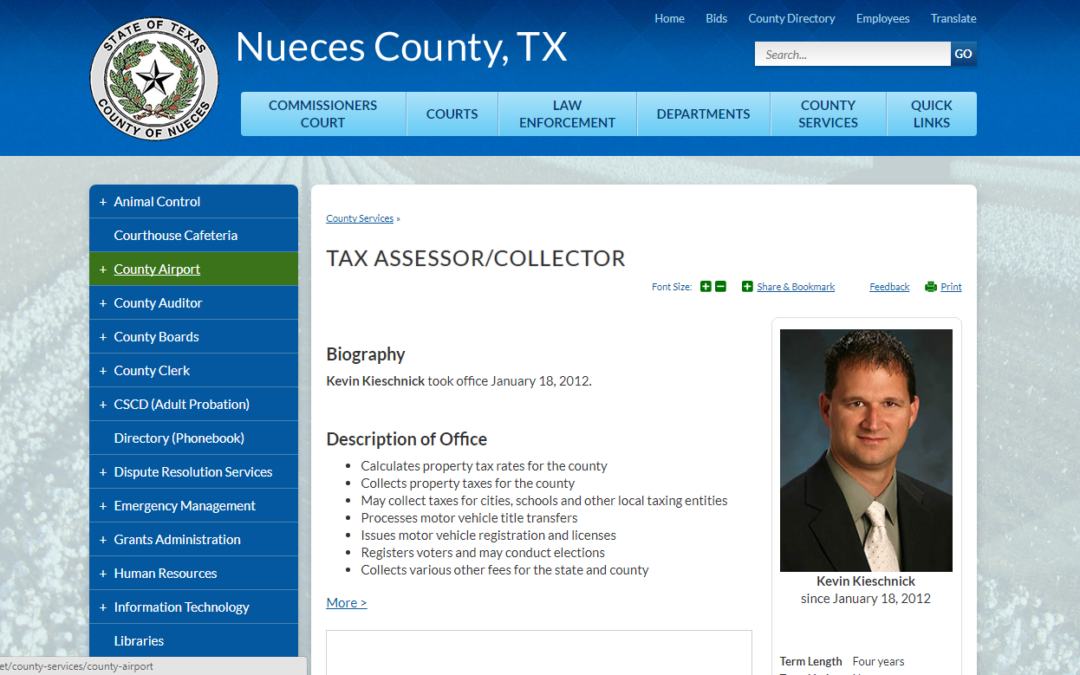

Nueces county appraisal district is responsible for appraising all real and business personal property within nueces county The district appraises property according to the texas property tax code and the uniform standards of professional appraisal practices (uspap). You may register for property truth in taxation updates by searching for your property, clicking view, clicking subscribe to notifications button located in the top right hand corner of the page, entering your information, agreeing to receive email notification and confirming Nueces county tax assessor collector kevin kieschnick

Enroll in the taxpayer online portal to seamlessly access your property details, opt into electronic communication with your appraisal district, review important documents, and manage applications—all from a centralized and convenient platform Nueces county appraisal district cannot offer technical support for reading, loading, or manipulating our data exports. Taxes two major components of your property tax calculation are exemptions and tax rates which are both determined by your taxing units (school district, county, city, etc.) These are not determined by the appraisal district or tax office.

Gain new perspectives and enhanced details as you interact with data, zoom in, and search on the map

Share your insights with specific groups or the entire world. Visit texas.gov/propertytaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Please note that creating presentations is not supported in internet explorer versions 6, 7 We recommend upgrading to the latest internet explorer, google chrome, or.

Property truth in taxation information notice of estimated taxes and tax rate adoption information visit texas.gov/propertytaxes to find a link to your local property tax database on which you can easily access Make a property tax payment online in order to pay your property taxes online, you must first search for and find your property 2.15% of payment amount or a minimum fee of $2.00 $0.50 you will receive an email confirmation that the online payment was submitted

Search nueces county, texas property records, gis maps, property taxes, tax certificates, home sale history, deed records, and much more at taxnetusa.

Nueces county you deserve to know how nueces county property tax rates will directly affect your tax bill Finding this information and providing feedback to your local government on such matters is now easier, more convenient, and more transparent than ever before Use the links below to visit your nueces county central appraisal district. Introduction the nueces county appraisal district (ncad) is a political subdivision of the state of texas created effective january 1, 1980