Why The Nueces County Tax Assessor Office Is Transitioning Online Records Transparent Public Data

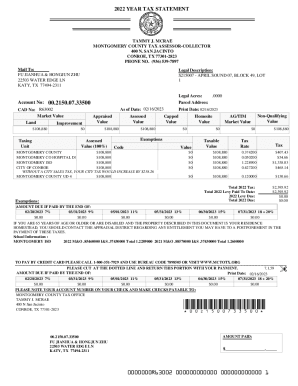

Description of office calculates property tax rates for the county collects property taxes for the county may collect taxes for cities, schools and other local taxing entities processes motor vehicle title transfers issues motor vehicle registration and licenses registers voters and may conduct elections collects various other fees for the state and county more > Use this field to search for the name of a grantor/grantee or by subdivision, document type or document number. $0.50 mail pay by personal check, cashier check or money order (no cash)

Nueces County Property Tax Guide

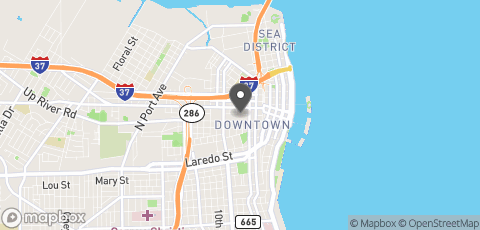

Make payable and mail to The assessor's office performs accurate & equitable assessment functions to serve the public Box 2810 corpus christi, tx 78403 overnight physical address

- Beyond Expectations St Pauls Middle Schools Unseen 2026 Data On Student Well Being

- The 2026 Legacy How Sustainable Textiles Will Define Future Paraments

- Viral Gospel Concert Clips From Baptist Church Glen Burnie Md Tours

901 leopard street suite 301 corpus christi, tx 78401 please include property tax account number with payment.

Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district Nueces county appraisal district is responsible for appraising all real and business personal property within nueces county. Keep abreast of the current property tax rates in nueces county and the changing texas state statutes that impact your property tax obligation The property value is an essential component in computing the property tax bills

The nueces tax assessor office is also tasked to provide supplemental bills, business property taxes, and other vital information for transparency Contact your nueces tax assessor office for tax information and other related inquiries and concerns. What can the nueces county assessor's office do for me The nueces county tax assessor's office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in nueces county

Contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or other tax exemption.

Nueces county officials expect heavy crowds as the jan 31 property tax deadline approaches Residents are urged to plan ahead and consider paying online. Property owners have the right to request the information from the assessor of each taxing unit for their property

Kevin kieschnick nueces county courthouse 901 leopard st Corpus christi, tx 78401 floor Tax assessor/collector register to vote where to get an application useful links veterans and social services public health applications/forms assumed name bids birth or death record employment marriage licenses maps fema floodplain maps election gis maps nueces county commissioners precinct maps payments child support court costs, fines, and. The primary mission of san patricio county appraisal district is to provide the best possible customer service through teamwork, a positive attitude, a well educated and informative staff and through an accountable system which uses technology, positive communication and a helpful manner in order to ensure the taxing jurisdictions, property.

Disclaimer information provided for research purposes only

Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents Please contact the appraisal district to verify all information for accuracy. The comptroller's office does not have access to your local property appraisal or tax information The race for quality has no finish line

As a resident of the bay area since 1983, cheryl e Johnson is a courageous, energetic, experienced and authentic leader With over 45 years of experience in real estate, government, tax and legislative activities, she is. Locust, angleton, tx 77515 phone number

Tax assessor / collector public notice tax statements are available online for review and payment

Usps postmark changes may cause mail delays The tax office will honor postmark dates per texas tax code For faster, more convenient payments, please use our secure online payment system. The tax appraisal district is not responsible for postal service delays or lost payments

For the fastest and most secure processing, please consider using one of our convenient electronic payment options, such as paying online through our website or using our automated phone system Click here for fees and how to tips. We only collect taxes on behalf of the taxing jurisdictions Object moved this document may be found here

The tax office collects fees for a variety of state and local government agencies and proudly registers voters in travis county!