Hidden Eligibility Requirements Inside The California Paid Sick Leave Law 2025 Carryover Key Updates For Hr

California's 2025 paid sick leave law raises the annual minimum from 24 to 40 hours for eligible employees statewide Learn how accrual works, what your policy must include, and how mosey helps employers stay compliant. Employers must follow accrual, notification, and exemption rules or face compliance risks under updated psl regulations.

California Sick Leave Law 2025 Carryover: Key Updates for HR

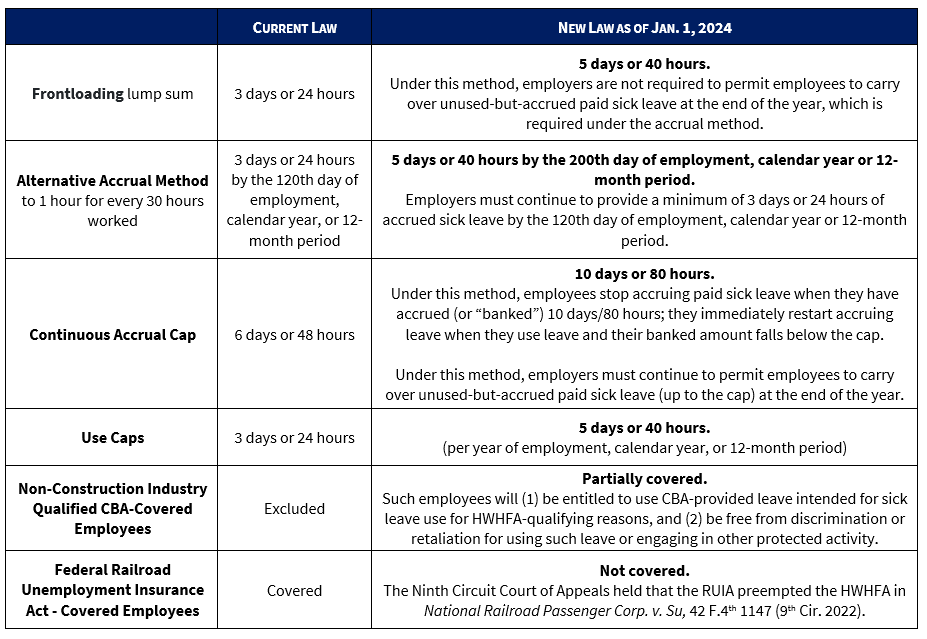

California's 2025 sick leave law mandates at least 40 hours or five days of paid leave for eligible employees Confused about california paid sick leave rules Side by side comparison of paid leave options paid leave options chart provides an overview of paid leave laws that may cover california workers affected by illness or injury, including laws on paid family leave, paid sick leave and disability payments

- The Holistic Care Philosophy Behind St Pauls House A Lutheran Life Community

- Sustainable Cities And Green Tech Building A Resilient Future Society

- Why The Sgb Weekly 2026 Digital Edition Surpassed Print Sales

Paid leave options beneficios de permisos february 2025

Paid sick leave has become a cornerstone of workplace compliance in california While federal law does not mandate general paid sick leave, california has steadily expanded its protections since the healthy workplaces, healthy families act of 2014 (ab 1522) Today, every california employer—large or small—must comply with a detailed set of rules governing accrual, use, and payout of sick. The new california paid sick leave (psl) law took full effect at the start of 2024 and introduced significant changes, such as increasing the minimum leave from 24 to 40 hours a year

This article will guide californian employers through staying compliant with updated legal requirements, unpacking eligibility criteria, workforce obligations, and more California's 2025 paid sick leave law. Key changes in california's sick pay law for 2025 the 2025 updates to california's sick pay law primarily focus on increased accrual rates and expanded eligibility criteria While specific numerical adjustments are subject to legislative finalization, the general direction points towards a more generous sick leave provision for employees.

The 2025 california sick leave law is now in effect

Learn how the updated sick leave policies impact employers and employees, including accrual vs Frontloading, compliance checks, and best practices to ensure policies are applied correctly. California's paid sick leave law, part of the healthy workplace healthy families act, underwent significant changes starting january 1, 2024 As of 2025, the regulations continue to set the standard for employee protections across the state.

By expanding eligibility, increasing accrual rates, and tightening compliance requirements, california has signaled a firm commitment to fair and supportive workplaces 1, california workers get new additions for paid sick leave in 2025, adding to what they can use it for. The paid sick leave law establishes minimum requirements for paid sick leave, but an employer may provide sick leave through its own existing sick leave or paid time off plan, or establish different plans for different categories of workers. California sick leave law 2025 explains employee rights, accrual rules, and employer duties for paid sick time in california

Local ordinances in los angeles, san francisco, oakland, berkeley, and santa monica offer additional protections and higher sick leave caps.

California sick pay requirements explained for 2026 Learn minimum paid sick leave, qualifying reasons, accrual rules, and your workplace rights. California 2025 sick leave law the california healthy workplaces, healthy families act of 2014 established a statewide paid sick leave program However, the law has undergone several updates, culminating in changes effective january 1, 2025, which further expanded employee access to paid sick leave.

What you need to know California boosted paid family leave and disability insurance benefits up to 90 percent of regular pay for many workers—a landmark increase that will make it much easier for californians to take time off for an illness or injury, or to care for loved ones. In 2025, several states have enacted or expanded paid sick leave laws, creating new compliance obligations for employers Whether your business operates in one state or across multiple jurisdictions, it's important to understand the specific requirements and prepare accordingly

Below is a summary of key developments and practical guidance for employers.

Summary paid sick leave refers to time off that workers can use if they are sick, injured, or require medical care It can also be used when an employee needs to attend to a family member or loved one for medical reasons, including elder care or child care Paid sick time also covers mental health … continue reading paid sick leave laws While employers have flexibility in offering paid vacation time, california law requires employers to adhere to federal and state laws that safeguard accrued leave.

With a whole new year ahead, here are five things to know about california's laws for paid sick leave. On december 2, 2024, the california department of industrial relations (dir) updated its frequently asked questions (faqs) about the state's paid sick leave requirements. Explore california paid sick leave, its significance, and how it protects your rights as an employee in the workplace. California's sb 616 increases paid sick leave from 24 to 40 hours, requiring policy updates for statewide employer compliance

Employers must adjust accrual, carryover, and usage rules, update handbooks, train staff, and ensure payroll accuracy.

Starting january 1, 2025, california workers will see significant changes to the state's paid family leave (pfl) program The california paid sick leave Frequently asked questions contains answers to questions that are frequently asked about california's paid sick leave law (ab 1522, operative january 1, 2015, as amended in ab 304 operative july 13, 2015, sb 3, operative april 4, 2016 and in sb 616 operative january 1, 2024).