Codigo Blas Cybersecurity Standards Implemented Across 2026 Banking Apps The Internet In Security Spiral Past Present And Future Of

Scope of the new standards the updated cybersecurity requirements apply to all banks, licensed digital payment providers, and fintech firms offering services within the country, regardless of the location of their data processing infrastructure. The bank faces the challenge of maintaining consistent cybersecurity practices across all regions, each with its own regulatory requirements and cybersecurity maturity levels. This guide outlines 15 key cybersecurity regulations for financial services, helping providers navigate compliance and safeguard sensitive data effectively.

Mobile banking | PDF

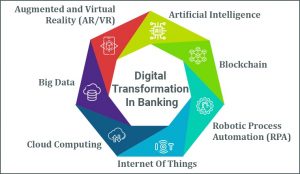

Banks face ai attacks, cloud risks & tighter rules in 2026 The facets of cybersecurity in fintech go beyond the security standards of banks and require the implementation of new strategies to deter a greater variety of threats due to the vulnerability of mobile apps, apis, and the disclosure of sensitive customer information. Learn how to overcome cybersecurity challenges and strengthen financial resilience.

- Inside The Sustainable Land Management Techniques Of Branch Kampe

- The 2026 Legacy How Sustainable Textiles Will Define Future Paraments

- Viral Op Eds In Sgb Weekly Spark Local Government Policy Debates

What is financial cybersecurity compliance

Financial cybersecurity compliance is the adherence to laws and security regulations setting the minimum standard for data security within the financial industry. Cybersecurity banks have the highest level of security among critical u.s Industries—and the most stringent regulatory requirements Aba's expertise and resources help ensure your bank understands the risk environment, and has the right plans in place to identify and prevent cyber incidents.

Banking cybersecurity 2026 explores cyber threats, ai phishing, ransomware, api risks, rbi rules, and effective defense strategies for banks. Both standards are to be implemented by 1 january 2026 The basel committee on banking supervision today published its final disclosure framework for banks' cryptoasset exposures and targeted amendments to its cryptoasset standard published in december 2022 Both standards have an implementation date of 1 january 2026.

Conclusion swift's 2026 incident response mandate represents a critical inflection point for global banking cybersecurity, requiring institutions to move beyond fragmented approaches toward standardized, tested, and documented response capabilities.

Fintech's evolution and corresponding cybersecurity solutions from digital banking to open finance, fintech has progressed through several key phases In a recent example, cybercriminals tricked an employee into authorizing $25.6 million in. Learn more about the top 7 cybersecurity frameworks that can help reduce cyber risk These frameworks show that you're adhering to it security best practices.

Consistent implementation can be achieved through centralized compliance oversight, appointing regional compliance officers, and fostering a culture of cybersecurity awareness through training and leadership engagement What are the key benefits of aligning global banking operations with bis cybersecurity standards? Jp morgan's $17 billion tech push) Beer highlighted how cloud computing and ai are reshaping the future of banking, transforming challenges into opportunities.

Explore microsoft products and services and support for your home or business

Shop microsoft 365, copilot, teams, xbox, windows, azure, surface and more. The best banking apps let you manage accounts, set up alerts, and more Investopedia's staff researched 15 top u.s Banking apps to recommend the best for the palm of your hand.

Department of defense (dod) developed the cybersecurity maturity model certification (cmmc) to enhance the cybersecurity practices of defense contractors Cmmc, which will be fully implemented by 2026, requires defense contractors to achieve specific cybersecurity maturity levels to bid on dod contracts. The cyber resilience act (cra) (regulation (eu) 2024/2847) marks a pivotal shift in the cybersecurity of products with digital elements Following the publication of the cra in the.

The national institute of standards and technology (nist) developed the cybersecurity framework (csf) as a standard that businesses can use as a tool to assess and manage cyber risk

By providing a common language and prioritization for security efforts, it offers a structured approach to enhancing cybersecurity. Cybercrime evolves quickly, so banks have to move at pace to keep their apps secure But users have a role to play as well. Explore key cybersecurity statistics, including threat types, breach frequency, industry impact, defense strategies, and global trends!

This year's reimagined conference promises to ignite your passion for security with world class keynotes, newly designed tracks , owasp project demo's, interactive pods, and mobileappseccon.

![The Internet Banking [in]Security Spiral: Past, Present, and Future of](https://image.slidesharecdn.com/slides-200509223249/85/The-Internet-Banking-in-Security-Spiral-Past-Present-and-Future-of-Online-Banking-Protection-Mechanisms-based-on-a-Brazilian-case-study-24-320.jpg)