Local Businesses Clash With The Nueces County Texas Tax Assessor Decisions Simple English Wikipedia Free Encyclopedia

Nueces county taxing entities faced budget shortfalls due to a texas policy requiring budgets to be based on potentially contested property valuations The assessor's office is located in the same building as the nueces county courthouse, at 901 leopard street, room 301. New legislation allows local governments to.

Nueces County Property Tax Guide

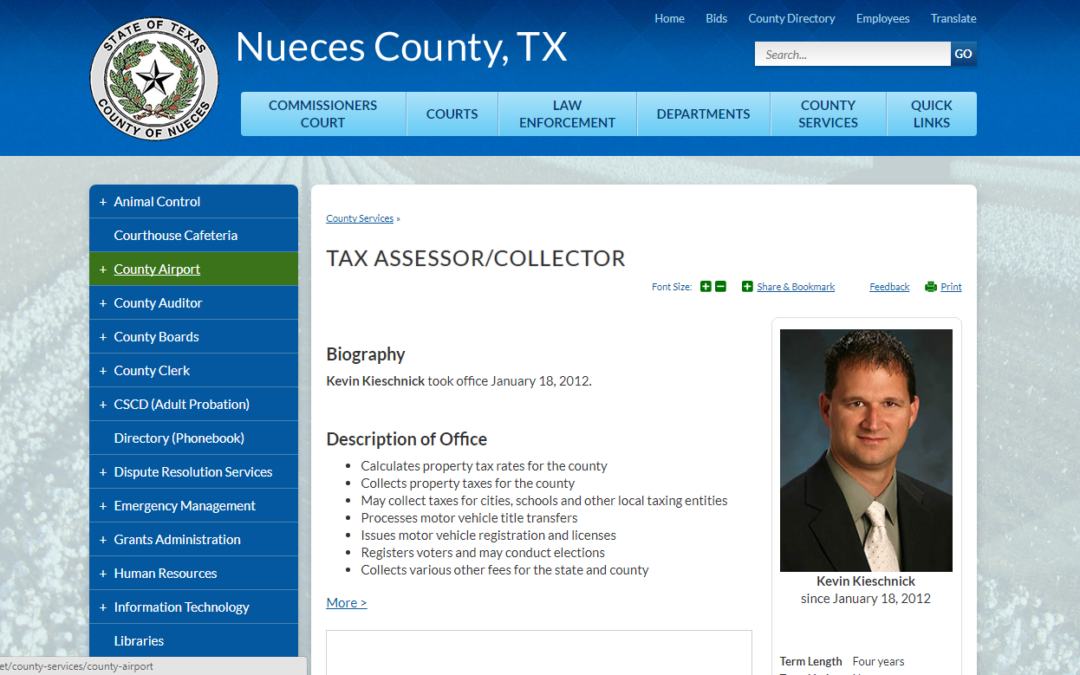

Description of office calculates property tax rates for the county collects property taxes for the county may collect taxes for cities, schools and other local taxing entities processes motor vehicle title transfers issues motor vehicle registration and licenses registers voters and may conduct elections collects various other fees for the state and county more > Corpus christi is the county seat of nueces county, where most local government offices are located O'connor saves nueces property owners millions of dollars annually by protesting the property tax assessment set by nueces central appraisal district

- St Paul Mcallen 2026 Regional Impact Award Celebrates Growth Gains

- New Data Reveals Surprising Academic Gains Across Schools In Glen Burnie

- Viral Op Eds In Sgb Weekly Spark Local Government Policy Debates

O'connor represents over 2,000 property owners annually in property tax protests in nueces county, representing owners of homes, commercial property and business personal property.

The city of corpus christi, nueces county, and del mar college contribute 100% of incremental property tax increases within tirz #3 to fund downtown revitalization projects. The nueces county appraisal district (nueces cad) assessed a 4% increase in residential properties in 2025, raising the total value of homes to $30.49 billion. A nueces county property tax protest is the legal process through which a property owner challenges the assessed value of their property as determined by the nueces county appraisal district. Corpus christi, texas — nueces county leaders are in austin talking to lawmakers about senate bill 1051, a measure which could bring new rules when it comes to the way the county calculates.

Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district Nueces county appraisal district is responsible for appraising all real and business personal property within nueces county. These challenges stemmed not from poor management or an economic downturn, but from an obscure flaw in texas property tax law. The nueces tax assessor office is also tasked to provide supplemental bills, business property taxes, and other vital information for transparency

Contact your nueces tax assessor office for tax information and other related inquiries and concerns.

County courts at law county court at law 1 county court at law 2 county court at law 3 county court at law 4 county court at law 5 court administrator calendar gonzales trial information district attorney cite and release program victims assistance district courts 28th district court (a) 94th district court (c) 105th district court (d) 117th. One county government, several school districts and a local community college will face significant budget shortfalls this year, unless a law is changed. Uncover property insights with the nueces county property tax search (nueces county appraisal district determines ownership and value for tax year) a tax lien attaches to all taxable property on this date to secure payment of taxes imposed for the year.

The tax office collects ad valorem property taxes for nueces county and 31 other taxing entities, which include six (6) municipalities, twelve (12) school districts, and eight (8) special districts. The nueces county assessor's office, located in corpus christi, texas, determines the value of all taxable property in nueces county, tx Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. County services » tax assessor/collector tax rates print share & bookmark font size

Use this field to search for the name of a grantor/grantee or by subdivision, document type or document number.

Calculates property tax rates for the county collects property taxes for the county may collect taxes for cities, schools and other local taxing entities processes motor vehicle title transfers issues motor vehicle registration and licenses registers voters and may conduct elections collects various other fees for the state and county more > Visit texas.gov/propertytaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Corpus christi, texas — nueces county leaders spent tuesday reviewing next year's budget — and a possible property tax rate increase is still on the table. Sheriff's office new mobile app new app for apple and android devices learn more

Reporting upgrades or improvements 901 leopard streetthe nueces county assessor's office is located in corpus christi, texas