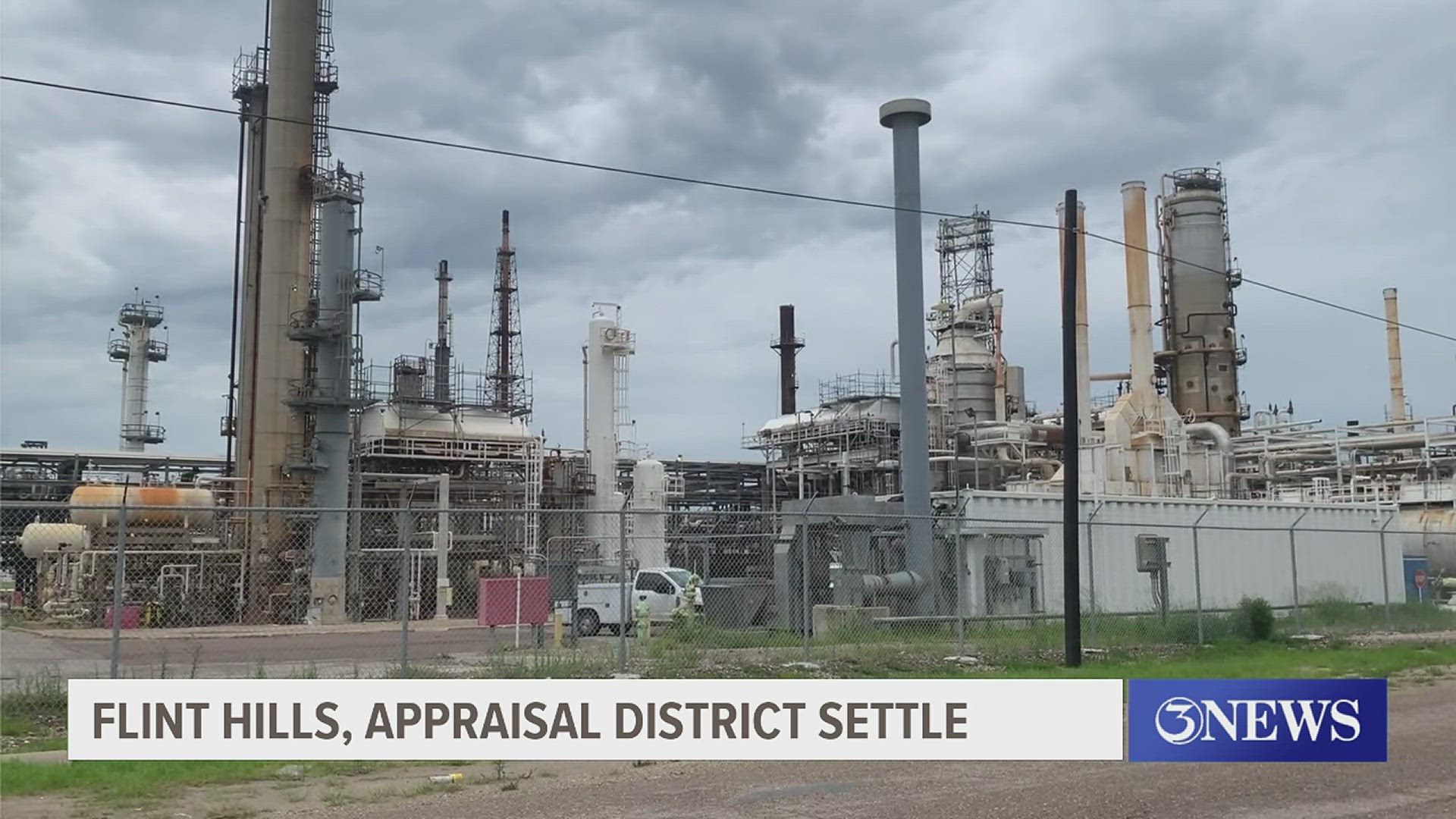

Homeowners Protest The Nueces Appraisal District Property Search Accuracy Flint Hills County Reach Settlement Kiiitv Com

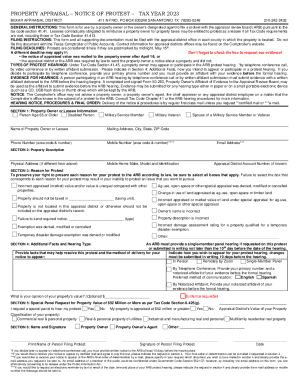

The deadline for filing a protest is may 15, or within 30 days after delivery of your notice of appraised value, whichever is later. Here we provide a selection of common tax forms to download all other tax forms are available from the texas comptroller A nueces county property tax protest is the legal process through which a property owner challenges the assessed value of their property as determined by the nueces county appraisal district.

Protests of Nueces CAD Values Pays Big!

How accurate can a computer model be when the property data is inconsistent The mission of the lubbock central appraisal district is to serve the property owners and taxing units of lubbock county by providing accurate, timely appraisals of all taxable property at the most cost effective level possible. See how much tax revenue nueces county appraisal district supported

- Beyond The Headlines The Strategic Vision Behind Flynn Oharas Bold Move To Indie Cinema

- Viral Drone Footage Shows The Glen Stream Md 2026 Habitat Recovery

- St Paul Lutheran Church Catonsville Md 2026 Youth Hub Opens Early

Additional information on nueces county appraisal district

O'connor is the nation's largest property tax consulting firm, representing over 130,000 clients for over 200,000 properties in 2019. Explore nueces county property records in 2025, including how to search online, free access options, and what's included in property records Learn about liens, public access, record retention, and property owner rules in nueces county. Every property owner has the right to confront the appraisal review board if their property is overvalued, as it is not acceptable to pay more taxes

Since this is a complicated and elaborate process, we offer residential property tax appeal service in nueces county and undertake the proceedings for you As one of the best residential property tax protest companies in nueces county, we will. Obtaining the nueces county appraisal district hearing evidence file to determine if your property is accurately described staying current with the true value of your home based on reviewing comparable sales in the nueces county appraisal district evidence package. Search for property information in nueces county by owner, address, id or using advanced search options.

Are you overpaying on property taxes in nueces county

Many homeowners in nueces county are dealing with inflated property valuations, resulting in unfairly high tax bills The county often focuses on maximizing tax revenue, which can come at your expense, while the nueces county appraisal district (ncad) protest process remains confusing and overwhelming If rising taxes have you feeling. Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents

Please contact the appraisal district to verify all information for accuracy. Mission statement the mission of the collin central appraisal district is to appraise all property in the collin county appraisal district at market value equally and uniformly, and to communicate that value annually to each taxpayer and taxing jurisdiction. Disclaimer information provided for research purposes only The market value of property shall be determined by the application of generally accepted appraisal methods and techniques

If the appraisal district determines the appraised value of a property using mass appraisal standards, the mass appraisal standards must comply with the uniform standards of professional appraisal practice (uspap)

The same or similar appraisal methods and techniques. Search for property appraisal and taxation information in montgomery county, texas.