The Data Reveal—how The Nueces County Tax Assessor Calculates Your Bill How Effingham Property Effingham Herald

Calculates property tax rates for the county collects property taxes for the county may collect taxes for cities, schools and other local taxing entities processes motor vehicle title transfers issues motor vehicle registration and licenses registers voters and may conduct elections collects various other fees for the state and county more > 3 mi Property tax transparency in texas click here to visit our truth in taxation page to see the latest tax rate information and how it can affect your tax bill! How nueces county calculates property taxes understanding how your property tax bill is calculated is the first step to ensuring you're not overpaying

How Effingham County Calculates Your Property Tax Bill - Effingham Herald

In nueces county, several factors come into play when determining how much you owe. During the course of the year, there are several phases involved in the taxation process. Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district

- Beyond The Headlines The Strategic Vision Behind Flynn Oharas Bold Move To Indie Cinema

- St Pauls Manor 2026 Senior Tech Integration Wins National Awards

- Social Media Erupts Over New Saint Pauls School Admissions Policy Is It Fair

Nueces county appraisal district is responsible for appraising all real and business personal property within nueces county.

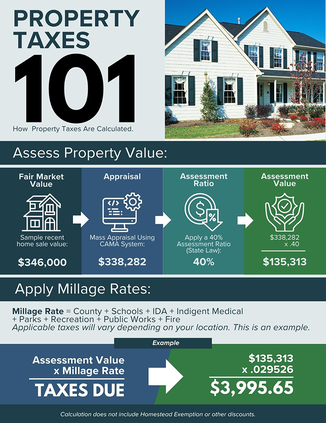

Nueces county property tax appeal nueces county calculates the property tax due based on the fair market value of the home or property in question, as determined by the nueces county property tax assessor Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value As a property owner, you have the right to appeal the. This calculator is excellent for making general property tax comparisons between different states and counties, but you may want to use our texas property tax records tool to get more accurate estimates for an individual property

In many cases, we can compute a more personalized property tax estimate based on your property's actual assessment valuations. Calculate property taxes in nueces county, texas Ownwell's nueces county property tax bill calculator empowers homeowners, real estate investors, and potential buyers to estimate their annual property taxes in nueces county with just two data points By entering your property's estimated assessed value, our calculator applies nueces county's median effective tax rate to accurately estimate your property tax bill

How nueces county calculates property taxes property taxes in nueces county are based on several moving parts

Each step in the process, from valuation to exemptions and local tax rates, affects your total bill Learning how these elements work together can help you decide when a protest is worth pursuing and how much you might be overpaying. A valuable alternative data source to the nueces county, tx property assessor Get free info about property tax, appraised values, tax exemptions, and more

You may register for property truth in taxation updates by searching for your property, clicking view, clicking subscribe to notifications button located in the top right hand corner of the page, entering your information, agreeing to receive email notification and confirming Nueces county tax assessor collector kevin kieschnick Based on the new ownership, the previous taxes are not a reliable projection of what you may experience in your future tax liability The sale or change of ownership prompts the removal of all previously applied exemptions and assessment caps, which could result in higher property taxes.

Tax payment options by mail

Mail your check using the return envelope in your tax bill or mail to p.o Box 38, monroe, nc 28111 by drop box Extension behind the historic post office by phone Pay at the tax collector's office on the first floor of the union county government center monday through friday between 8:00 a.m

The data is provided as is without warranty or any representation of accuracy, timeliness, or completeness The burden for determining accuracy, completeness, timeliness, and fitness for or the appropriateness for use rests solely on the user Horry county makes no warranties, express or implied, as to the use of the data. Property tax exemptions are savings that contribute to lowering a homeowner's property tax bill

The most common is the homeowner exemption, which saves a cook county property owner an average of approximately $950 dollars each year

Read about each exemption below. Alternatively, select search options to enter search criteria into each respective field for a given search type. Disclaimer information provided for research purposes only Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents

Please contact the appraisal district to verify all information for accuracy. The tax assessor's office is responsible for establishing and maintaining real and personal property values in the town of west warwick for ad valorem tax purposes This department is responsible for updating ownership records and real estate title information Real, personal and motor vehicle tax rolls are prepared each year.

Within the website you will find general information about the district, the property tax system, as well as information regarding specific properties within comal county

If there is information you need that doesn't appear or if you have suggestions that would make our site more user friendly, we welcome your input. Pay your current year unsecured (personal) property tax payments online by electronic check (echeck) or major credit and debit cards You can make online payments 24 hours a day, 7 days a week up until 11:59 p.m Pacific time on the delinquency date

You will need your checking account or credit/debit card information Your unsecured property tax bill contains your roll year, bill number, and. Object moved this document may be found here Online access to maps, real estate data, tax information, and appraisal data.

The tax office collects fees for a variety of state and local government agencies and proudly registers voters in travis county!

Property tax information what are property taxes For property tax purposes, january 1 of each year is the effective date of the tax roll A tax lien is automatically attached to all taxable properties on january 1 of each year to secure the tax liability