The Accurate Way To Use Nueces County Cad Property Search For Taxes Real At Cory Tack Blog

Disclaimer information provided for research purposes only Description of office calculates property tax rates for the county collects property taxes for the county may collect taxes for cities, schools and other local taxing entities processes motor vehicle title transfers issues motor vehicle registration and licenses registers voters and may conduct elections collects various other fees for the state and county more > Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents

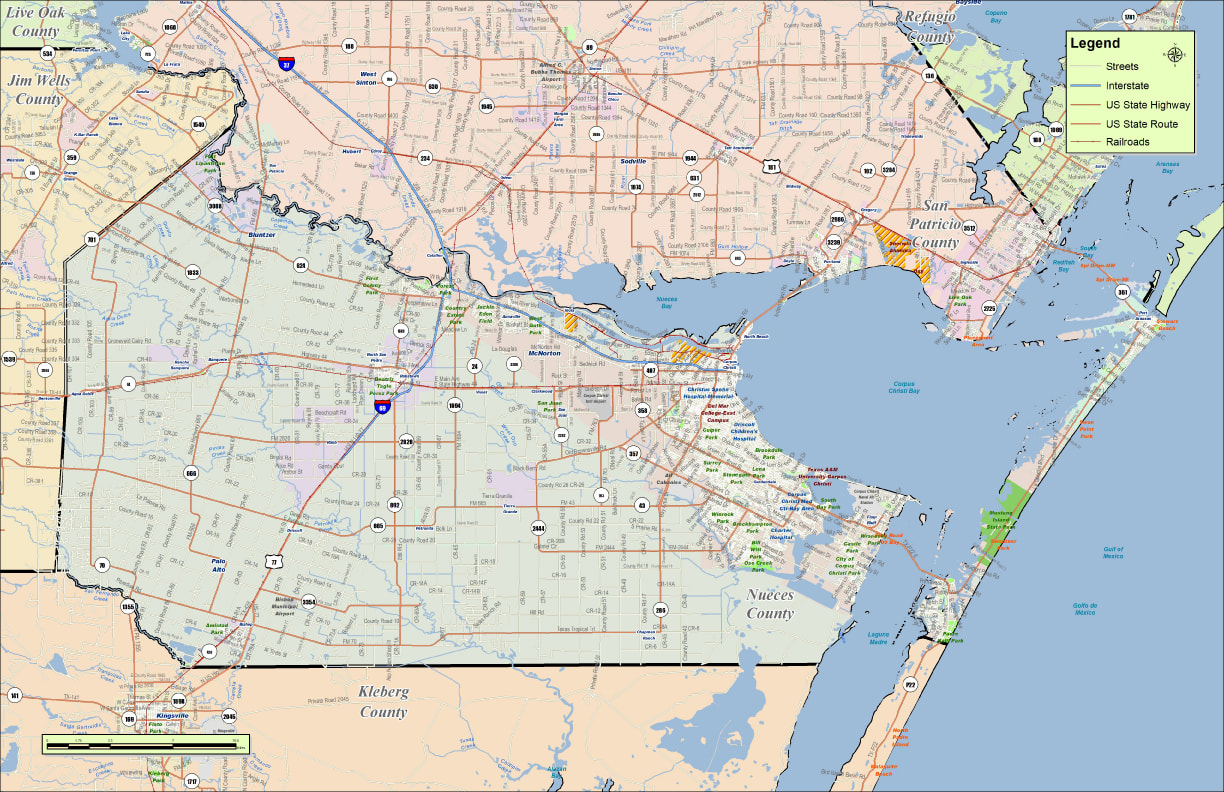

Nueces County Property Tax: How to Navigate Your 2025 Tax Assessment

Please contact the appraisal district to verify all information for accuracy. Conduct your property records search today! In order to pay your property taxes online, you must first search for and find your property

- Sustainable Cities And Green Tech Building A Resilient Future Society

- New Study Reveals Unseen Link St Paul Allergy Spike Tied To Urban Green Spaces

- The Grand Avenue Project Charting The Next Decade For St Paul

2.15% of payment amount or a minimum fee of $2.00.

Explore nueces county property records in 2025, including how to search online, free access options, and what's included in property records Learn about liens, public access, record retention, and property owner rules in nueces county. Search nueces county, texas property records, gis maps, property taxes, tax certificates, home sale history, deed records, and much more at taxnetusa. Tax records in nueces county (texas) explore a directory of tax record services in nueces county, tx

Access public tax records, tax lien records, and property tax records through official resources Retrieve tax documents, search property tax history, and find detailed tax information online Use the links to navigate tax assessments, exemptions, payments, and delinquent tax sales from. Search for property information in nueces county by owner, address, id or using advanced search options.

Use the directory below to find your local county's truth in taxation website and better understand your property tax rate

Meets second wednesday of every month, at 9:00 a.m., board room, nueces county appraisal district, 201 north chaparral, corpus christi, texas. Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district Nueces county appraisal district is responsible for appraising all real and business personal property within nueces county. Land records in nueces county (texas) find comprehensive land records for nueces county, tx

Access county land records, parcel information, property title searches, and ownership verification Use public records to verify property boundaries and contact the land record office for detailed inquiries Enroll in the taxpayer online portal to seamlessly access your property details, opt into electronic communication with your appraisal district, review important documents, and manage applications—all from a centralized and convenient platform The nueces county tax assessor's office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in nueces county.

Introduction the nueces county appraisal district (ncad) has prepared this plan as a requirement under section 6.05 of the texas property tax code

This report is designed to provide property owners and taxing entities with a complete understanding of the biennial (every other year) Introduction the nueces county appraisal district (ncad) is a political subdivision of the state of texas created effective january 1, 1980 The provisions of the texas property tax code govern the appraisal district's legal, statutory, and administrative requirements A board of directors, appointed or elected by the taxing units within the boundaries of nueces county, constitutes the.

The nueces county appraisal district (ncad) has prepared this plan as a requirement under section 6.05 (a) and section 25.18 of the texas property tax code This report is designed to provide property owners and taxing entities with a complete understanding of the biennial reappraisal process of the The mission of the nueces county appraisal district is to discover, list and appraise all property located within the boundaries of the district in an accurate, ethical, and impartial manner in an effort to estimate the market value of each property and achieve uniformity and equity between classes of properties. The nueces county appraisal district (ncad) is a political subdivision of the state of texas created effective january 1, 1980

The texas property tax code governs the appraisal district's legal, statutory, and administrative requirements.

The nueces county appraisal district (ncad) identifies property to be taxed, determines its appraised value, whether to grant exemptions, the taxable owner and address, and which taxing jurisdictions may tax the property. Explore nueces county, tx property records 🏡, transaction records, land office details, and appraisal info