Nueces County Tax Assessor: New 2026 Property Valuation Rules Announced Print All Years Maricopa Assessor's Office

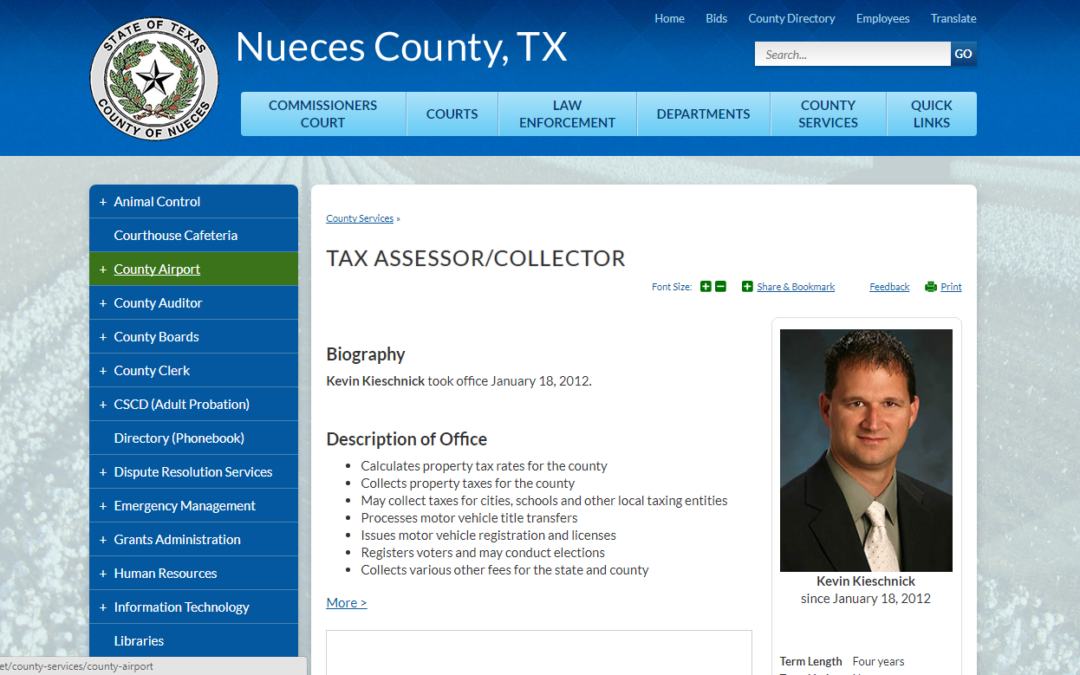

Kevin kieschnick took office january 18, 2012 Get expert guidance and maximize your savings now. Nueces county taxing entities faced budget shortfalls due to a texas policy requiring budgets to be based on potentially contested property valuations

Tax Assessor - Winston County, Mississippi

Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district. Learn how to protest and reduce your nueces county property tax with texas tax protest Property tax information for nueces county, texas, including average nueces county property tax rates and a property tax calculator.

- Viral Tiktok Clips From Hershey Coed Soccer Championship Final Games

- Why Saint Paul Early Childhood Ministries 2026 Play Lab Is Viral

- Why Glen Stream Md 2026 Water Purity Results Shocked Local Experts

What a property is used for on january 1, market conditions at the time, and who owns the property on that date, determine whether the property is taxed, it's value, and who is responsible for paying the tax.

Understand nueces county property tax assessments, deadlines, appeals, and exemptions to ensure you're not overpaying in 2025. Nueces county adopted a tax rate that will raise more money for maintenance and operations than last year's tax rate The tax rate will effectively be raised by 9.07 percent and will raise taxes for maintenance and operations on a $100,000 home by approximately $26.02. Property tax appraisals go out during the first week of april and values are going up at a normal pace for a growing area

On tuesday, 3news sat down with nueces county chief appraiser. Explore nueces county property records in 2025, including how to search online, free access options, and what's included in property records Learn about liens, public access, record retention, and property owner rules in nueces county. Calculate your property taxes in nueces county, texas using official county tax rates

Get accurate estimates and understand your tax obligations with our comprehensive calculator.

Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district Nueces county appraisal district is responsible for appraising all real and business personal property within nueces county. The nueces county property appraiser is responsible for determining the taxable value of each piece of real estate, which the tax assessor will use to determine the owed property tax. Learn all about nueces county real estate tax

Whether you are already a resident or just considering moving to nueces county to live or invest in real estate, estimate local property tax rates and learn how real estate tax works. Pay in person credit card processing fee 2.35% of payment amount pay online attention you are now leaving the nueces county's web site Continue to the online vehicle registration

Registrations can also be renewed

Stores (must not be expired or need new plates) original renewal notice is required by mail (mail to Po box 2810, corpus christi, tx 78403) by internet at www. County services » tax assessor/collector tax rates print share & bookmark font size Enroll in the taxpayer online portal to seamlessly access your property details, opt into electronic communication with your appraisal district, review important documents, and manage applications—all from a centralized and convenient platform

County courts at law county court at law 1 county court at law 2 county court at law 3 county court at law 4 county court at law 5 court administrator calendar gonzales trial information district attorney cite and release program victims assistance district courts 28th district court (a) 94th district court (c) 105th district court (d) 117th. Make a property tax payment online in order to pay your property taxes online, you must first search for and find your property 2.19% of payment amount or a minimum fee of $2.00 online check fee (ach) $1.00 you will receive an email confirmation that the online payment was submitted

Nueces county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections

In order to pay your property taxes online, you must first search for and find your property 2.15% of payment amount or a minimum fee of $2.00. The tax office collects ad valorem property taxes for nueces county and 31 other taxing entities, which include six (6) municipalities, twelve (12) school districts, and eight (8) special districts.