Nueces County Cad Property Search: 2026 Appraisal Value Tool Updates Real Search At Cory Tack Blog

Explore nueces county property records in 2025, including how to search online, free access options, and what's included in property records Nueces county appraisal district is responsible for the fair market appraisal of properties within each of the following taxing entities: Learn about liens, public access, record retention, and property owner rules in nueces county.

Nueces County Real Property Search at Cory Tack blog

Nueces county tx appraisal district real estate and property information and value lookup The district appraises property according to the texas property tax code and the uniform standards of professional appraisal practices (uspap) Phone, website, and cad contact for the cities of agua dulce, alice, banquete, bishop, chapman ranch, corpus christi, driscoll, port aransas, portland, robstown, sandia.

- Inside The Elite College Prep Strategy At St Pauls High School Baltimore

- St Pauls Cathedral New 2026 Restoration Project Reveals Roman Foundations

- New Study Reveals Unseen Link St Paul Allergy Spike Tied To Urban Green Spaces

Search nueces county, texas property records, gis maps, property taxes, tax certificates, home sale history, deed records, and much more at taxnetusa.

Meets second wednesday of every month, at 9:00 a.m., board room, nueces county appraisal district, 201 north chaparral, corpus christi, texas. Explore nueces county, tx property records 🏡, transaction records, land office details, and appraisal info Conduct your property records search today! Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district

Nueces county appraisal district is responsible for appraising all real and business personal property within nueces county. Search for property information in nueces county by owner, address, id or using advanced search options. Tax records in nueces county (texas) explore a directory of tax record services in nueces county, tx Access public tax records, tax lien records, and property tax records through official resources

Retrieve tax documents, search property tax history, and find detailed tax information online

Use the links to navigate tax assessments, exemptions, payments, and delinquent tax sales from. The nueces county appraisal district (ncad) identifies property to be taxed, determines its appraised value, whether to grant exemptions, the taxable owner and address, and which taxing jurisdictions may tax the property. Please do not submit your protest of appraised value on this question and help page, any protest submission on the question and help section will be disregarded Please follow the instructions that were included in your notice of appraised value letter

A copy of those instructions are also available at this link here. You may register for property truth in taxation updates by searching for your property, clicking view, clicking subscribe to notifications button located in the top right hand corner of the page, entering your information, agreeing to receive email notification and confirming Nueces county tax assessor collector kevin kieschnick To register as a taxpayer, use the property credentials listed on your appraisal notice from the appraisal district

If you are an agent, please visit the appraisal district's homepage to access and register through the agent portal.

By filling out the form below, you are requesting the nueces county appraisal district change your mailing address Please fill in all sections or your request will not be able to be processed. Nueces county appraisal district taxpayer concerns and information center in order to streamline taxpayer concerns and requests and better serve you the taxpayers of nueces county, we utilize a ticketing system for question and concerns Every request is assigned a unique ticket number which can be used to track the progress and responses online.

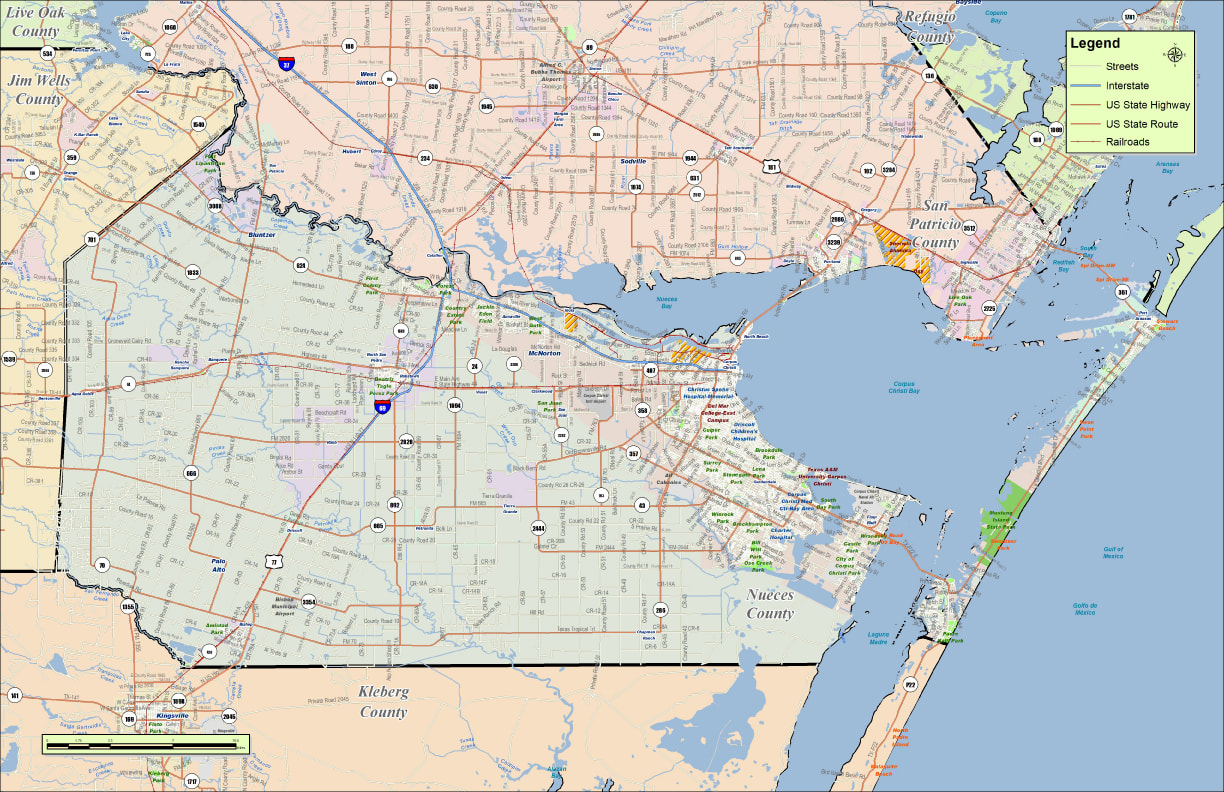

2024 partial exemption list 2023 partial exemption list 2022 partial exemption list 2021 partial exemption list County courts at law county court at law 1 county court at law 2 county court at law 3 county court at law 4 county court at law 5 court administrator calendar gonzales trial information district attorney cite and release program victims assistance district courts 28th district court (a) 94th district court (c) 105th district court (d) 117th. The mission of the nueces county appraisal district is to discover, list and appraise all property located within the boundaries of the district in an accurate, ethical, and impartial manner in an effort to estimate the market value of each property and achieve uniformity and equity between classes of properties. Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents

Please contact the appraisal district to verify all information for accuracy.

In order to pay your property taxes online, you must first search for and find your property 2.15% of payment amount or a minimum fee of $2.00. Some properties appraised by the nueces county appraisal district (ncad) are eligible for electronic filing of a protest for excessive appraisal and/or unequal appraisal on residential property. Nueces county appraisal review board members (ncarb) the arb's role in the property tax system the appraisal review board (arb) is the judicial part of the system

The arb is a separate body from the appraisal office and serves a different function It hears and resolves disputes over appraisal matters. The texas property tax code, under sec 25.18, requires each appraisal office to implement a plan to update appraised values for real property at least once every three years

Appraised values district wide are reviewed annually and are subject to change for.